Introduction: The N442bn AMCON Levy and Its Implications

In 2025, Nigeria’s major banks collectively incurred N442 billion in AMCON expenses, signaling a growing financial strain on the sector. This marks a 34% increase compared to the N330 billion recorded in the same period in 2024. The increase in AMCON contributions comes at a time when several banks are experiencing declining profits, reflecting broader systemic challenges in Nigeria’s banking industry.

This article provides a deep analytical perspective on the interplay between rising AMCON levies and falling bank profitability. It examines individual bank performance, regulatory frameworks, macroeconomic implications, and strategic considerations for the sector.

The focus keyword “Big banks incur N442bn in AMCON expenses amid falling profit” will be used throughout this analysis to optimize search visibility while ensuring a natural human tone.

Understanding AMCON and Its Role in Nigeria’s Banking Sector

The Asset Management Corporation of Nigeria (AMCON) was established in 2010 with the primary objective of stabilizing the financial system by acquiring non-performing loans (NPLs) from banks. Under the AMCON (Amendment) Act 2015, banks are required to contribute 0.5% of total assets plus contingent liabilities annually to fund AMCON’s operations.

Why AMCON Exists

- Stabilize banks burdened with toxic assets

- Restore investor confidence in the Nigerian financial system

- Support capital adequacy and liquidity during periods of financial stress

While AMCON has successfully mitigated systemic banking crises, its ongoing levy has become a significant cost for banks, directly affecting profit margins, return on equity (ROE), and lending capacity.

Deep Dive: N442bn AMCON Levy and Bank-by-Bank Analysis

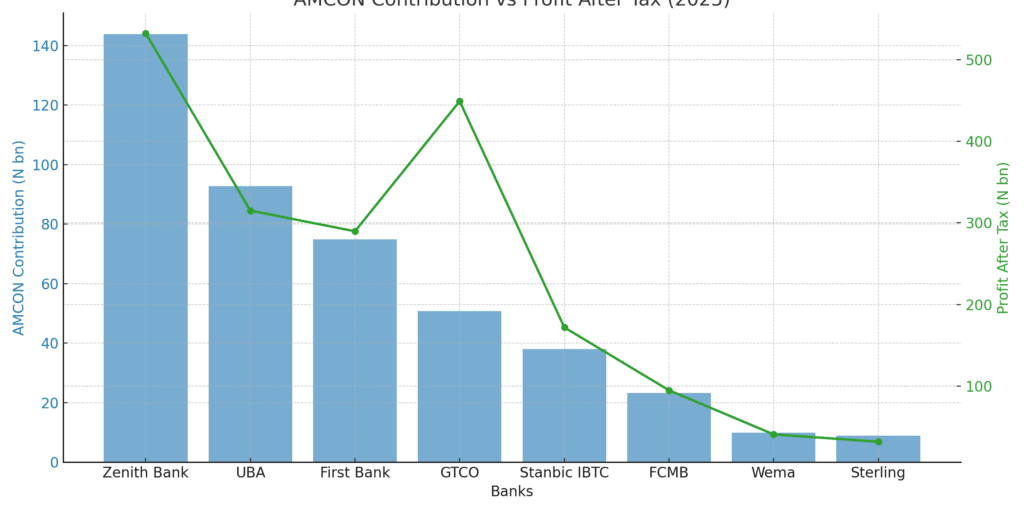

In the first half of 2025, Nigeria’s top banks recorded the following AMCON contributions:

| Bank | AMCON Contribution (Naira) | Change from 2024 | Profit After Tax (Naira) | ROE (%) |

|---|---|---|---|---|

| Zenith Bank | 143.8bn | +56% | 532.2bn | 18.2 |

| UBA | 92.8bn | +32% | 315.0bn | 16.8 |

| First Bank HoldCo | 74.8bn | -3% | 289.7bn | 15.5 |

| GTCO | 50.8bn | – | 449bn | 14.9 |

| Stanbic IBTC | 38bn | – | 172bn | 13.6 |

| FCMB | 23.3bn | – | 95bn | 12.1 |

| Wema Bank | 9.9bn | – | 41bn | 10.7 |

| Sterling Financial Holding | 8.89bn | – | 32bn | 9.5 |

Observations

- Zenith Bank leads in both AMCON contributions and total assets, reflecting its market dominance.

- GTCO’s profits have fallen by nearly 50% despite moderate AMCON contributions, highlighting operational challenges.

- Smaller banks like Wema and Sterling face a disproportionate cost burden relative to profits.

The trend shows that AMCON levies are increasing faster than profits, pressuring banks’ operational and strategic flexibility.

Analytical Insights on Declining Bank Profitability

Several factors contribute to declining profitability amid rising AMCON levies:

1. Interest Rate Pressures and Funding Costs

- High Central Bank of Nigeria (CBN) policy rates have increased cost of funds for banks.

- Banks face a squeeze on net interest margins (NIMs), reducing profitability.

2. Non-Performing Loans and Impairment Charges

- Despite AMCON’s efforts to absorb toxic loans, banks continue to face high NPLs, requiring provisions that further depress profits.

- Example: GTCO and First Bank HoldCo saw a rise in impairment charges by 15–20% year-on-year.

3. Operational Costs and Efficiency Ratios

- Banks’ cost-to-income ratios have increased, partly due to expanding digital infrastructure and compliance costs.

- Rising AMCON contributions exacerbate the strain on operational efficiency.

4. AMCON Levy Impact on Net Margins

- The AMCON levy effectively reduces net margins by 1–2%, which translates to billions of naira lost annually.

- Analysts warn that continued high levies may limit banks’ lending capacity to corporates and SMEs.

Macroeconomic Implications of Rising AMCON Levies

The rising cost of AMCON contributions affects more than bank profitability:

1. Lending Capacity and Credit Supply

- With higher levies and declining profits, banks may reduce credit to the real sector, impacting businesses and households.

2. Investment Confidence

- Foreign investors monitor profitability trends closely; declining ROE coupled with high levies may deter capital inflows.

3. Effect on GDP Growth and SMEs

- Reduced bank lending slows SME expansion, which can dampen GDP growth.

- Sectors reliant on credit, such as manufacturing and agriculture, may see slower development.

Risk Assessment and Strategic Implications for Banks

1. Managing Regulatory Levies

- Banks must optimize asset allocation to minimize levy exposure.

- Strategic debt structuring and capital management can reduce effective AMCON contributions.

2. Capital Adequacy and Liquidity

- Maintaining high capital adequacy ratios (CAR) and sufficient liquidity buffers is critical amid rising regulatory costs.

3. Diversification Strategies

- Expanding non-interest income streams (fees, advisory services, investment banking) can offset declining net interest income.

- Digital banking initiatives can improve efficiency and reduce operational costs.

Calls for Reform: Industry Perspectives and Policy Recommendations

- Industry stakeholders argue that AMCON levies are excessive and unsustainable in the long term.

- Proposed reforms:

- Gradual reduction of AMCON contributions as banks strengthen balance sheets.

- Targeted support for smaller banks to avoid disproportionate burden.

- Enhanced transparency and performance monitoring of AMCON interventions.

- Experts emphasize the need to balance financial stability with profitability, ensuring banks can support economic growth without being overburdened by regulatory costs.

RELATED:

How Local Investors Drove Nigeria’s Equities Trading to an 18-Year High in 2025

How Nigeria’s New Finance Playbook in 2025 Reshapes the Business and Investment Landscape

Conclusion: Strategic Takeaways

The N442bn AMCON expenses amid falling profits reveal the growing financial pressure on Nigeria’s banking sector. While AMCON has stabilized banks historically, its ongoing impact on profitability demands:

- Strategic cost management by banks

- Policy review by regulators

- Strengthened risk management frameworks

- Focused support for smaller institutions

For investors, understanding the interplay between AMCON levies, profitability trends, and macroeconomic impact is essential for informed decision-making.

weed products shipping secure tracked

Can you be more specific about the content of your article?