The global financial landscape in 2025 is experiencing a critical shift as U.S. mortgage rates climb past 7%, the highest since mid-2024. While this may seem distant for most Nigerians, the ripple effects are strongly felt in the local real estate market. Investors, homebuyers, and developers across Nigeria are facing rising costs, fluctuating exchange rates, and shifts in capital flows, all of which influence property demand and affordability. This article provides an in-depth analysis of the impact of rising U.S. mortgage rates on Nigerian real estate buyers, offering data-driven insights, regional breakdowns, and practical advice for navigating 2025’s challenging property market.

1. U.S. Mortgage Rates in 2025: Global Implications

Current Trends and Causes

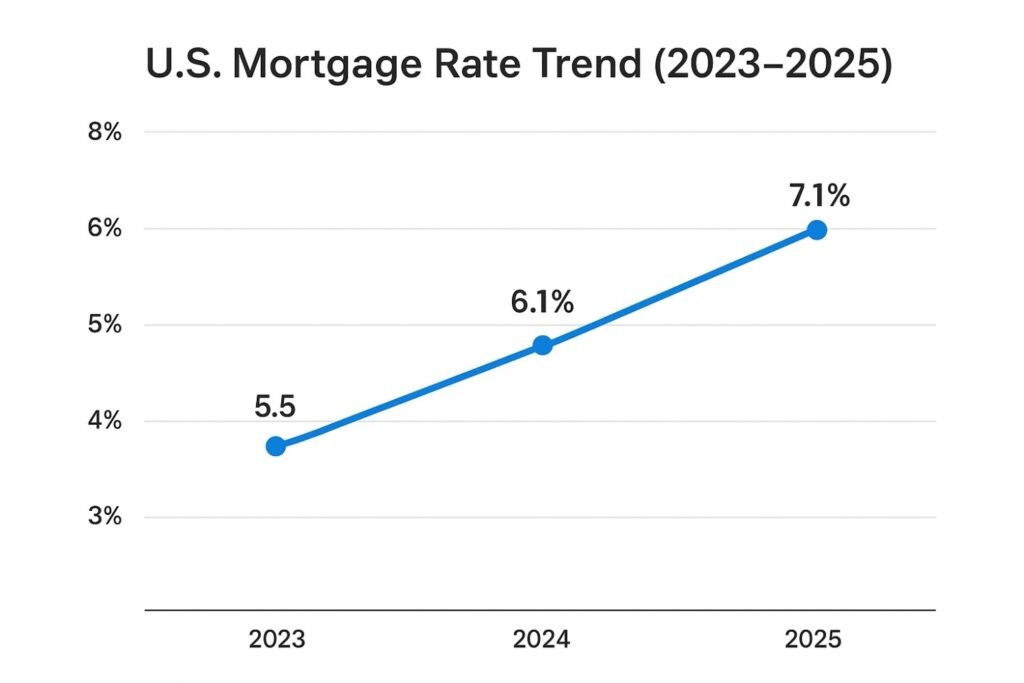

In 2025, U.S. mortgage rates have risen steadily, surpassing 7% due to a combination of persistent inflation, high property prices, and aggressive monetary policies by the Federal Reserve. The consequences are immediate and multi-layered:

- Slower Housing Sales: Existing home sales in the U.S. have dropped by approximately 5% year-over-year, signaling caution among American buyers.

- Increased Borrowing Costs: Mortgage payments for average U.S. homes are significantly higher, making refinancing less attractive.

- Global Capital Shifts: International investors, including those from emerging markets, are channeling funds into U.S. assets to take advantage of higher returns.

Global Ripple Effects

Nigeria, as one of Africa’s largest economies, is directly influenced by U.S. financial movements:

- Capital Outflows: Investors shift funds from Nigerian markets to the U.S., leading to liquidity shortages in domestic sectors.

- Currency Pressure: Reduced foreign investment contributes to naira depreciation, making imports, including construction materials, more expensive.

- Investment Reassessment: Diaspora investors must balance U.S. returns against property opportunities in Nigeria, often delaying or reducing local investment.

Mortgage Rate Comparison (2024 vs 2025)

| Country | Average Mortgage Rate 2024 | Average Mortgage Rate 2025 | % Change |

|---|---|---|---|

| USA | 6.1% | 7.1% | +16% |

| Nigeria | 21.5% | 22.0% | +2.3% |

Source: CBN, Federal Reserve, Nigerian Mortgage Refinance Company

2. Nigerian Real Estate Market Overview

Market Size and Growth

The Nigerian real estate market remains one of the most promising in Africa. As of 2025:

- Total Market Value: Estimated at over $2.9 trillion.

- Projected Growth: 7.5% CAGR expected through 2028.

- Primary Drivers: Urbanization, rising middle-class population, government infrastructure investments, and growing commercial hubs.

Regional Breakdown

- Lagos: Lagos remains the most expensive and competitive market. Luxury apartments in Victoria Island and Lekki are experiencing slower uptake due to high mortgage costs.

- Abuja: Government-driven development and foreign investment have maintained demand, though higher borrowing costs limit middle-income participation.

- Port Harcourt & Other Emerging Cities: Secondary cities are witnessing increased interest from developers focusing on affordable and mid-range housing due to lower entry costs.

Housing Segments in Demand

- Affordable Housing: Middle-income Nigerians account for the largest market share. Government incentives, like NHF and FHF schemes, increase accessibility.

- Luxury & Premium Housing: Sales slowed in 2025 due to high financing costs and cautious diaspora investments.

- Mixed-Use Developments: Increasingly popular as investors seek diversified revenue streams and mitigated risk.

Regional Property Prices in Nigeria 2025 (Naira)

| City | 1-Bedroom Apartment | 3-Bedroom Apartment | Average Plot (per sqm) |

|---|---|---|---|

| Lagos | ₦18,000,000 | ₦55,000,000 | ₦120,000 |

| Abuja | ₦15,000,000 | ₦48,000,000 | ₦100,000 |

| Port Harcourt | ₦12,000,000 | ₦38,000,000 | ₦85,000 |

| Kano | ₦7,000,000 | ₦22,000,000 | ₦50,000 |

Source: Nigerian Bureau of Statistics (NBS), Local Developers’ Reports

3. Capital Flight and Currency Effects

Foreign Capital Withdrawal

Data from the Nigerian Stock Exchange shows a withdrawal of N420.37 billion by foreign investors in Q1 2025, up 250% from the same period in 2024. This trend directly affects real estate development:

- Liquidity Crunch: Developers struggle to secure funding for large-scale projects.

- Increased Construction Costs: Import-dependent materials like cement and steel become more expensive due to naira depreciation.

- Investor Caution: Both local and diaspora investors adopt a wait-and-see approach, limiting speculative purchases.

Naira Depreciation and Mortgage Impact

The naira’s decline against the U.S. dollar increases the real cost of imported goods and services used in construction. Nigerian buyers taking out mortgages denominated in naira face higher effective costs, squeezing disposable income and limiting purchasing power.

4. Mortgage and Financing Challenges in Nigeria

Current Mortgage Landscape

- Average Mortgage Rate: 22.04%

- Prime Lending Rate: 18.54%

- Average Loan Tenure: 15–20 years for middle-income buyers

These rates remain prohibitively high, especially when global capital seeks safer returns in the U.S. market.

Government Initiatives

- Mortgage Refinancing and Restructuring Facility (MFRRF): Offers long-term funding to banks to lower mortgage rates.

- National Housing Fund (NHF): Provides affordable housing loans to contributors.

- Family Homes Fund (FHF): Focused on subsidizing housing for low and middle-income earners.

Alternative Financing Options

- Cooperative Societies: Pool resources to fund property purchases.

- Seller Financing: Developers provide in-house loans to buyers.

- Joint Ventures: Investors partner with developers to share risk and returns.

5. Diaspora Investments & Property Trends

Diaspora Buying Behavior

Nigerians living abroad have traditionally been key investors in local real estate:

- Remittances: Over $35 billion sent home in 2024 contributed to property purchases.

- Investment Patterns: Preference for Lagos and Abuja, primarily in residential properties.

- Shift in 2025: Rising U.S. mortgage rates reduce disposable income, limiting diaspora buying capacity.

Case Studies

- Lagos Buyer Example: A Nigerian professional in the U.S. intending to buy a Lekki apartment delayed purchase due to higher mortgage commitments at home and abroad.

- Abuja Developer Example: Focused on mid-income housing to attract diaspora buyers, offering flexible payment plans to mitigate exchange rate fluctuations.

6. Affordable Housing & Emerging Opportunities

Market Demand

Affordable housing continues to be the most resilient segment:

- Government Incentives: Tax breaks and land allocations attract developers.

- Steady Demand: Middle-income Nigerians and returning diaspora prioritize affordable homes.

Developer Strategies

- Modular Construction: Reduces construction time and cost.

- Mixed-Use Projects: Combines residential, commercial, and retail space for diversified income.

- Flexible Financing: Installment plans and cooperative schemes to attract buyers.

Return on Investment

Affordable housing projects often deliver ROI in 5–7 years, compared to luxury developments with uncertain timelines due to slower sales.

7. Practical Advice for Nigerian Buyers

- Monitor Global Financial Trends: U.S. mortgage rates and naira exchange rates directly affect affordability.

- Diversify Investments: Avoid focusing solely on luxury apartments; consider mixed-use and mid-income developments.

- Explore Alternative Financing: Cooperative societies, seller financing, and joint ventures can reduce upfront costs.

- Leverage Government Programs: NHF and FHF provide lower-cost housing solutions.

- Engage Real Estate Experts: Consultants can provide localized insights to navigate market volatility.

8. Future Outlook & Policy Recommendations

Expected Market Trends

- Urbanization: Lagos, Abuja, and emerging cities will continue to see high demand.

- Technology: Digital property platforms will increase transparency and efficiency.

- Foreign Investment: Dependent on global rates and Nigerian market stability; may gradually return if incentives increase.

READ MORE: Africa’s Fintech Boom: What It Means for Banks’ Digital Future

Policy Recommendations

- Stabilize Mortgage Rates: Continued government support to lower financing costs is essential.

- Encourage Affordable Housing: Tax incentives and land grants for mid-income projects.

- Enhance Data Transparency: Regular market reports to guide investors and buyers.

9. FAQ Section

Q1: How do rising U.S. mortgage rates affect Nigerian buyers?

A1: Higher U.S. rates encourage capital outflow, leading to naira depreciation, increased construction costs, and higher local mortgage rates.

Q2: Is Lagos still the best market for Nigerian real estate investment in 2025?

A2: Yes, but prices are high; emerging cities may offer better ROI in mid-income housing.

Q3: Can diaspora investors still buy property affordably in Nigeria?

A3: Yes, by leveraging flexible payment schemes, government programs, and currency timing strategies.

Conclusion

Rising U.S. mortgage rates in 2025 significantly influence Nigerian real estate buyers through capital outflows, currency depreciation, and higher local borrowing costs. Affordable housing, mixed-use developments, and alternative financing strategies offer opportunities for investors who adapt quickly. Staying informed about global trends, regional market dynamics, and government incentives is essential for success in 2025 and beyond.

Disclaimer

Data and analysis in this article are based on information available as of September 2025. Readers are advised to verify current market conditions before making investment decisions.

Leave a Reply