For years, banks believed digitization would secure their relevance in the future of finance. They invested in mobile apps, online transfers, and card networks, expecting steady revenue growth. Yet across Africa and other emerging markets, evidence now shows banks’ digital earnings are slowing — even as overall transaction volumes rise.

Why banks’ digital earnings are slowing as fintechs expand dominance: Fintechs like Kuda, Moniepoint, PalmPay, MNT-Halan, Mukuru, and TymeBank are capturing market share with lean infrastructure, customer-first design, and aggressive funding, shifting earnings and reshaping the balance of power in financial services.

Why Banks’ Digital Earnings Are Stalling

1. Declining Margins on Transfers and Cards

Banks once relied on transfer charges and card fees for consistent digital income. But in Nigeria, for example, NIBSS data for 2024 showed electronic transaction volumes up 54% year-on-year, while fee income for top-tier banks grew by less than 10%. Customers are shifting to fintech apps offering zero-fee or cashback transfers.

2. Rising Cost of Legacy Infrastructure

Maintaining outdated core banking systems has become a drag. Deloitte’s 2024 Africa Banking Report estimated banks spend 15–20% of operating costs on IT maintenance, compared to 5–7% for fintechs that run cloud-native platforms. Each upgrade cycle eats into profits while fintechs scale faster.

3. Slow Innovation and User Experience

Banking apps often require multiple steps for onboarding, with documentation hurdles that discourage low-income or first-time users. By contrast, digital banks like Kuda (“Bank of the Free”) open accounts in minutes with no card issuance fees. Such frictionless onboarding makes traditional bank apps less competitive.

4. Regulatory Pressure on Fee Structures

Governments and regulators, keen on boosting financial inclusion, are capping bank charges or introducing open banking rules that weaken banks’ pricing power. In Kenya, the Central Bank pushed for mobile money interoperability, allowing fintechs to operate seamlessly across telcos, further squeezing banks’ market share.

How Fintechs Are Expanding Dominance

1. Digital-Only Banks

Kuda (Nigeria) markets itself as “the bank of the free.” With over 6 million users, it eliminated maintenance fees and card charges, offering micro-loans and savings features directly through its app. For young Nigerians, Kuda has become more trusted for everyday digital transactions than traditional banks.

TymeBank (South Africa), launched in 2019, reached 8 million customers by 2024, largely by targeting first-time account holders with simple fee structures and partnerships with supermarkets for account opening.

2. SME and Agent Banking Ecosystems

Moniepoint (Nigeria) has built one of Africa’s largest SME ecosystems. Originally an agent banking platform, it now provides credit, payments, payroll, and tax tools to over 1.6 million small businesses. By embedding itself in merchants’ daily operations, Moniepoint has become indispensable — a role banks often overlooked.

3. Consumer Loyalty Platforms

PalmPay, backed by Chinese investors, offers cashback on every transfer, bill payment, and airtime purchase. Its rewards-driven approach has made it one of Nigeria’s fastest-growing wallets, surpassing several traditional banks in active monthly users.

4. Credit for the Underbanked

In Egypt, MNT-Halan has emerged as a fintech powerhouse, serving over 5 million customers with digital credit, ride-hailing integrations, and e-commerce payments. It targets segments banks have historically ignored — informal traders, rural households, and gig workers.

In Southern Africa, Mukuru provides cross-border remittances for migrants, many of whom cannot access formal bank accounts. With over 10 million customers across 13 countries, Mukuru demonstrates how fintechs capture entire populations banks failed to serve.

5. Local Language and Offline Access

Unlike banks, fintechs embrace local languages and USSD access. Zoona in Zambia built its brand by offering customer service in local dialects and focusing on “community tellers” for cash-in and cash-out. This cultural adaptation is crucial in markets where literacy and English proficiency are barriers.

Regional Dynamics

Nigeria: Banks Lose Payments Battle

Despite robust earnings from loans and corporate banking, Nigerian banks are losing consumer digital payments to fintechs. CBN’s 2024 Electronic Payment Report showed fintech-led wallets handled 67% of mobile transfers, compared to 43% in 2021. Moniepoint and PalmPay are now among the top five processors by volume, outpacing banks in retail activity.

READ MORE: Mastering Finance &Money: From Personal Budgeting to Wealth Growth

Kenya: Beyond M-Pesa, Banks Struggle

Kenya’s banks once hoped mobile banking partnerships would counterbalance M-Pesa. Instead, telco-led fintech dominance is entrenched. Equity Bank has shifted strategy, investing in regional expansion rather than competing head-on with Safaricom.

Egypt: Government Push for Fintech

Egypt’s Vision 2030 policy actively supports fintech innovation. While banks like CIB remain strong in corporate services, consumer adoption of Fawry and MNT-Halan is accelerating. The government’s Meeza card program was initially bank-led but has since been outpaced by fintech wallets.

South Africa: Neobanks Enter the Field

South Africa’s banking sector remains sophisticated, but fintechs like TymeBank and Yoco (merchant payments) are carving out niches. Traditional banks still dominate mortgages and wealth products, but fintech adoption among youth is steadily climbing.

Zambia and Ghana: New Frontiers

In Zambia, Zoona and digital credit providers are serving rural communities banks struggle to reach. In Ghana, mobile money interoperability has made fintech wallets essential for commerce. Banks, while still trusted for deposits, lag in transaction volumes.

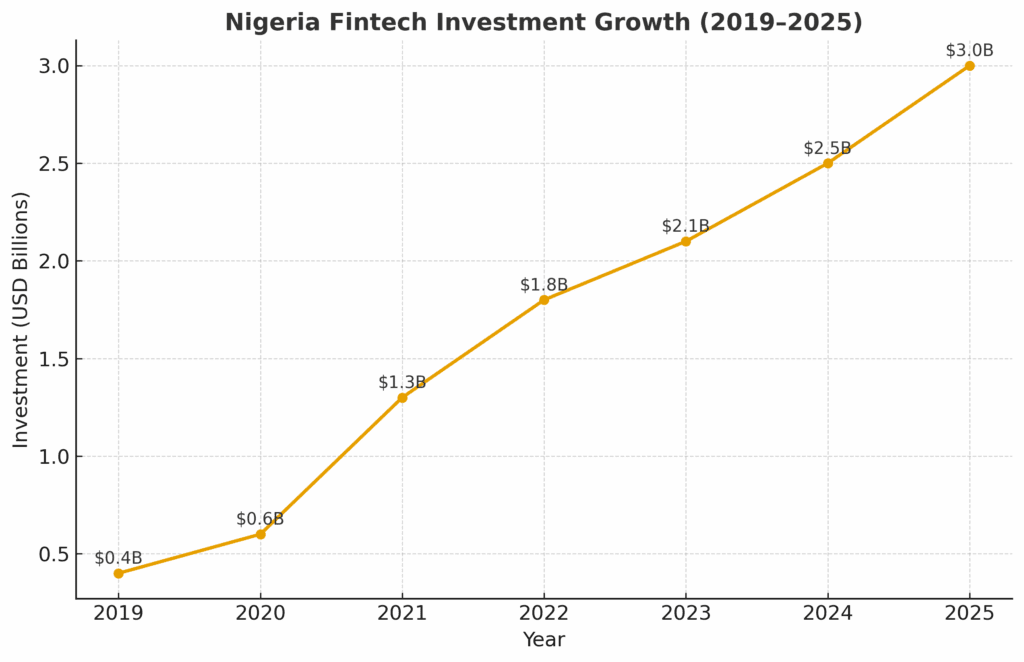

Investor Perspective

Venture capital continues to flow disproportionately toward fintechs. According to Briter Bridges’ 2024 Africa Investment Report, fintech attracted 45% of all startup funding, totaling $1.9 billion, while banks raised none from equity markets beyond traditional bond issuances.

Investors like IFC, Helios Investment Partners, TLcom, and Partech Africa see fintech as high-growth bets with clear exit opportunities. By contrast, banks are seen as dividend-paying but low-growth institutions.

Private equity is also betting on agent networks and SME ecosystems. In 2023, Helios acquired a minority stake in Moniepoint, citing its ability to scale across Nigeria’s fragmented SME base.

Regulatory Shifts

- Nigeria: The Central Bank is tightening rules for digital lenders but also promoting open banking APIs, which will benefit fintech integrations.

- Kenya: New licensing laws in 2022 gave fintechs legitimacy while ensuring consumer protection.

- Egypt: Sandboxes allow fintech pilots to reach scale quickly.

- South Africa: Discussions on open finance are ongoing, with fintech associations pushing for equal data access.

Regulators balance financial stability with innovation, but the momentum is clearly toward enabling fintech participation.

Risks Ahead

For Fintechs

- Dependence on venture funding leaves them vulnerable during global downturns.

- Cybersecurity breaches can quickly erode trust.

- Over-competition in Nigeria, where more than 250 fintechs operate, may thin margins.

For Banks

- Erosion of fee income as free or discounted fintech transfers become the norm.

- Generational trust gap: younger customers see fintechs as their default financial partners.

- Digital irrelevance: Without innovation, banks risk becoming “invisible pipes” for fintech services.

Outlook: A New Financial Order

The financial services map of Africa and other emerging markets is being redrawn. In the next five years:

- Banks will likely double down on corporate banking, wealth management, and partnerships with fintechs rather than compete in retail transfers.

- Fintechs will pursue cross-border growth, embedding themselves in daily commerce.

- Regulators will expand open banking and data-sharing rules, accelerating the trend.

For consumers, the outcome is clear: cheaper, faster, and more inclusive services. For investors, fintech remains the hotbed of growth. For banks, survival requires humility and adaptation.

READ ALSO:

How Local Investors Drove Nigeria’s Equities Trading to an 18-Year High in 2025

How Nigeria’s New Finance Playbook in 2025 Reshapes the Business and Investment Landscape

FAQs

Q1: Why are banks’ digital earnings slowing down?

Banks’ digital revenues are slowing due to declining margins on transfers, rising infrastructure costs, and customer migration to fintech wallets offering cheaper services.

Q2: Which fintechs are driving dominance in Africa?

Notable examples include Kuda, Moniepoint, PalmPay, MNT-Halan, Mukuru, TymeBank, and Zoona.

Q3: How are regulators responding?

Central banks are introducing open banking rules, digital credit licenses, and sandboxes to balance innovation with financial stability.

Q4: What is the investor trend?

VC and PE investors are directing billions toward fintechs, while banks are seen as low-growth institutions.

Q5: What does this mean for consumers?

Consumers benefit from lower fees, faster transactions, and greater financial inclusion, especially in rural and underserved areas.

References

- Deloitte Africa Banking Report 2024

- NIBSS – Nigerian Inter-Bank Settlement System Transaction Data 2024

- CBN – Electronic Payments Report 2024

- Briter Bridges – Africa Investment Report 2024

- GSMA – State of Mobile Money 2024

- IFC – Investments in African Fintechs

- Equity Bank Annual Report 2024

- Safaricom M-Pesa Data 2024

- Egypt Vision 2030 – Financial Inclusion Roadmap

- TymeBank Press Release 2024

Author

Written by Obaxzity, financial markets analyst and contributor on fintech, banking, and digital transformation across Africa and emerging markets.

Leave a Reply