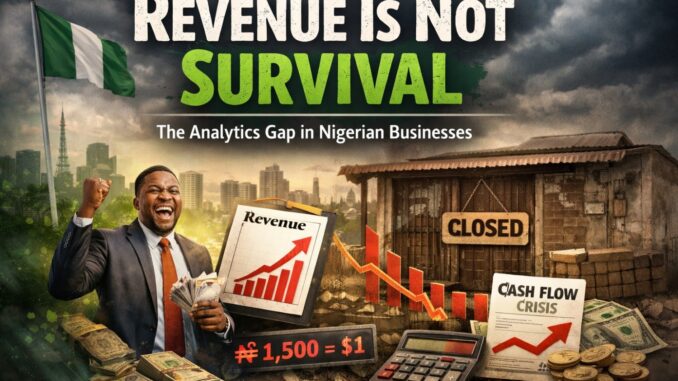

“Sales grew 20% this quarter.”

“Turnover hit a new high.”

“Our revenue is up month-on-month.”

These are the statements Nigerian business owners proudly announce at board meetings across Lagos, Abuja, Port Harcourt, and Kano. And why not? Sales numbers are easy to quantify, easy to celebrate, and easy to report.

But in Nigeria’s unpredictable economic environment, revenue alone is no guarantee that a business will survive. Sales growth does not always translate into cash in the bank, resilient margins, or operational sustainability.

This article explores the analytics gap in Nigerian businesses — where revenue is tracked obsessively, yet the survival signals that determine longevity are largely ignored. It blends data, real examples, and survival metrics to expose the silent crisis many enterprises face.

Nigeria’s Economic Context: Inflation and FX Pressures

Before analyzing business survival, it is important to set the stage with macroeconomic realities that affect all Nigerian enterprises.

Inflation Trends (2024–2026)

| Month | Headline Inflation (YoY) | Source / Note |

|---|---|---|

| Dec 2024 | 34.80% | Peak food & transport inflation (NBS, 2024) |

| Aug 2025 | 20.12% | Costs remain elevated despite easing (Punch Nigeria, 2025) |

| Dec 2025 | 15.15% | Continued moderation (Guardian Nigeria, 2025) |

| Jan 2026 | 15.10% | Slight further easing (Reuters, 2026) |

Interpretation: Even with slowing inflation, businesses face high operating costs. Firms that budget for moderate cost increases may still experience squeezed margins.

READ MORE: Why Nigerian Businesses Fail Despite Good Sales: The Cash Flow Trap Nobody Talks About

Foreign Exchange Movements

FX volatility is another critical pressure:

- Official naira rate (2026): ₦1,450–₦1,550–₦1,334 per $1

- Parallel market volatility: occasional spikes beyond official rates

Impact: Import-reliant SMEs see sharp cost increases when FX shifts, even if sales remain steady. For example, a 5% naira depreciation on imported raw materials can increase costs substantially without any change in revenue.

Sources: BusinessDay, Punch Nigeria

SME Survival Reality

Despite reporting strong revenue, Nigerian SMEs face high failure rates:

- 80% of SMEs fail before year five (BusinessDay, 2025)

- 30% of registered MSMEs closed in 2023–2024, equating to millions of lost jobs (Tekedia, 2025)

Clearly, turnover alone does not indicate survival. Financial resilience — cash flow, margins, working capital efficiency — is what determines who endures and who closes.

The Analytics Gap in Nigerian Businesses

Most Nigerian businesses focus on sales reporting:

- Daily or weekly revenue

- Number of units sold

- Customer count

They ignore metrics that truly predict survival:

| Category | Commonly Tracked | Survival Signals Often Ignored |

|---|---|---|

| Revenue |  ︎ ︎ |

Inflation-adjusted margins Inflation-adjusted margins |

| Gross Profit | Sometimes |  ︎ ︎ |

| Operating Cash Flow |  |

︎ ︎ |

| Cash Runway |  |

︎ ︎ |

| Receivable Aging |  |

︎ ︎ |

| Inventory Turnover |  |

︎ ︎ |

| FX Exposure |  |

︎ ︎ |

| Customer Concentration |  |

︎ ︎ |

| Debt Coverage Ratio |  |

︎ ︎ |

Implication: Businesses often appear to grow in revenue while survival risks quietly accumulate.

Revenue Misleads: A Lagos Retail Example

Consider a Lagos retailer:

- Dec 2025 revenue: ₦250 million

- Jan 2026 revenue: ₦280 million (12% growth)

At first glance, the business is thriving. But closer inspection:

- Inventory costs rose 18% due to FX and supplier price adjustments

- Transport & energy costs up 12%

- Receivable collection period increased from 30 to 60 days

- Gross margin fell from 28% to 16%

The business is generating more revenue but losing liquidity and profitability. This is the analytics gap in action.

Inflation Effects on Revenue vs Real Profitability

Revenue numbers can disguise real declines:

- Item sold last year: ₦100

- Item sold this year: ₦130

- Unit sales stable

- Revenue rises 30% nominally

Reality: Costs may have increased by 35%, meaning real margin declined despite higher revenue.

Lesson: Businesses must track inflation-adjusted gross margins, not just top-line sales.

RELATED:

Nigeria’s Import Policy Changes Explained: How Traders Can Adapt and Profit

Cash Flow Forecasting Analytics: Mastering Financial Predictability in 2026

FX Exposure and Risk

Many Nigerian SMEs rely on imports:

- Supplier invoices in USD

- Shipment of $10,000

- Naira depreciation of 5% → extra ₦500,000 cost

Revenue in naira may appear steady, but survival risk rises. FX exposure is invisible in revenue reports — a hidden survival signal.

Metrics Every Nigerian Business Must Track

To survive, firms should measure:

1. Operating Cash Flow

Shows actual cash in and out — the liquidity heartbeat.

2. Cash Conversion Cycle (CCC)

CCC = Inventory Days + Receivable Days − Payable Days

Indicates how long cash is tied in operations.

3. Gross Margin Adjusted for Inflation

Revenue minus inflation-adjusted costs gives true profitability.

4. Customer Concentration Ratio

Revenue dependency on few customers creates fragility.

5. Debt Service Coverage Ratio

Ability to pay interest & principal from operating cash.

6. FX Exposure Ratio

Percentage of costs linked to imported inputs.

Working Capital Comparison Example

| Indicator | Firm A | Firm B |

|---|---|---|

| Monthly Revenue | ₦150m | ₦150m |

| Inventory Days | 90 | 50 |

| Receivable Days | 75 | 35 |

| Payable Days | 30 | 45 |

| CCC | 135 days | 40 days |

Analysis: Firm A has revenue similar to Firm B but faces much higher cash cycle risk, reducing survival probability.

Root Causes of High Failure Rates

- Sales Obsession Over Financial Discipline

- Informal Accounting Practices

- Reactive Decision-Making

- Lack of Survival Analytics Tools

These factors combine to create the illusion of growth while vulnerability increases.

Closing the Analytics Gap: Step-by-Step

- Build a Survival Dashboard

- Operating cash flow

- Cash runway

- Receivables and inventory days

- FX exposure trends

- Conduct Monthly Stress Tests

- Revenue drop scenarios

- Cost inflation shocks

- FX devaluation simulations

- Use Integrated Digital Tools

- Accounting software

- Inventory management

- Payment/collection systems

- Management Review Ritual

- Monthly boardroom discussion of survival metrics

Key Takeaway

Revenue shows activity. Survival metrics show durability.

Businesses that understand:

- Cash flow health

- Real margins after inflation

- FX exposure

- Working capital efficiency

…are the ones that will endure Nigeria’s economic volatility.

Turnover alone will not protect a business from unexpected shocks. Survival intelligence does.

References

- National Bureau of Statistics (NBS, 2026) — CPI & Inflation Data

- Punch Nigeria (2025–2026) — Inflation & FX Reporting

- Guardian Nigeria (2025) — Monthly Inflation Analysis

- BusinessDay Nigeria (2025) — SME Failure Statistics

- Tekedia SME Reports (2025) — MSME Closures

- SME Portal Nigeria — Survival & Analytics Guidance

Frequently Ask Questions (FAQs)

1. Why do Nigerian businesses fail even with high revenue?

Most SMEs focus only on sales and revenue growth, ignoring survival metrics like cash flow, working capital, and FX exposure. Without these, high turnover can mask financial fragility.

2. What are the key survival metrics Nigerian SMEs should track?

Important metrics include operating cash flow, cash conversion cycle, inflation-adjusted gross margins, customer concentration, debt coverage ratio, and FX exposure. These predict resilience better than revenue alone.

3. How does inflation and FX volatility affect business survival?

Inflation increases operating costs, while FX fluctuations raise import prices. Businesses that track only revenue may appear profitable but actually lose liquidity and real margins due to these hidden pressures.

4. How can SMEs close the analytics gap?

By implementing survival dashboards, monthly stress tests, digital accounting tools, and reviewing working capital, cash flow, and risk exposures regularly, businesses can move from reactive reporting to predictive decision-making.

Leave a Reply