Introduction: How MPOWER Financing Can Change Your Life

Studying abroad is a dream many Nigerian students chase, but funding it is often the biggest hurdle. Traditional student loans usually require cosigners, collateral, or an excellent credit history, which most students don’t have.

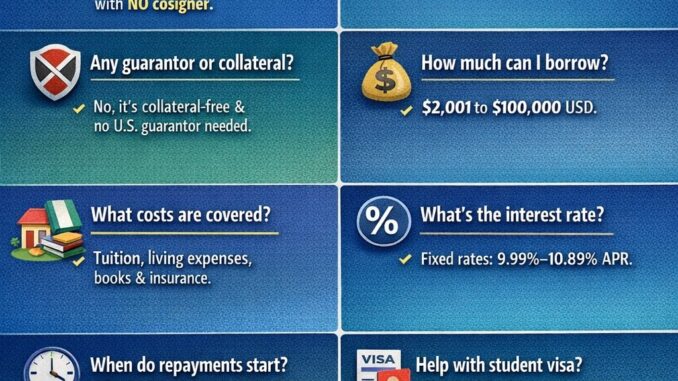

Enter MPOWER Financing — a no-cosigner, no-collateral loan solution designed for students like you. Unlike traditional loans, MPOWER evaluates your future earning potential rather than your current financial situation.

This guide (MPOWER Financing Nigeria) is for Nigerian students who want to fully understand MPOWER, weigh the benefits and risks, and make informed decisions. We’ll cover everything — loan terms, application process, repayment planning, currency risks, real-life scenarios, and strategic tips.

What Is MPOWER Financing?

MPOWER Financing is a U.S.-based student loan provider founded in 2014. Its mission is to help international students access higher education without traditional barriers like cosigners or collateral.

Key Features for Nigerian Students

- Loan amounts: $2,001 – $100,000

- Fixed interest rates: starting at 9.99%

- Repayment: 10 years with a 6-month grace period

- Interest-only payments while studying

- Extra support: visa letters, career tools, and U.S. credit building

MPOWER is more than just a loan — it’s an investment in your future.

Why Nigerian Students Should Consider MPOWER

- No Cosigner Requirement

Most international student loans require a U.S.-based guarantor. MPOWER removes this barrier completely. - High Loan Amounts

With a ceiling of $100,000, you can cover tuition, housing, books, and other school-certified costs. - Predictable Fixed Rates

Your payments stay the same, helping with budgeting and planning. - Build U.S. Credit History

Timely payments help establish a U.S. credit record, useful for future loans or credit cards. - Holistic Support

MPOWER provides visa letters, career support, and financial literacy guidance — all included in your loan package. - Financial Inclusion & Social Impact

MPOWER supports first-generation students and underrepresented groups, empowering students who might otherwise be excluded.

How MPOWER Financing Works

MPOWER uses an innovative underwriting model based on your future earning potential. Here’s a breakdown:

- Risk Assessment: Focuses on potential, not collateral

- Revenue Model: Interest payments plus a small origination fee (~5%)

- Support Services: School disbursement, visa letters, career resources

This approach aligns with global trends in merit-based financing while reducing barriers for international students.

MPOWER Loan Terms for Nigerian Students

Eligibility

- Admission to a MPOWER-approved university in the U.S. or Canada

- Passport, transcripts, and admission letter

- No cosigner or collateral needed

Loan Amount & Usage

- $2,001 – $100,000

- Covers tuition, housing, books, and certified expenses

Interest & Repayment

- Fixed rates starting at 9.99%, discounts for autopay/on-time payments

- Interest-only payments while in school

- 6-month grace period post-graduation

- 10-year repayment term, no prepayment penalties

Realistic Scenarios & Repayment Simulation

Scenario 1: Master’s Student in STEM

- Loan: $60,000

- Interest Rate: 10% fixed

- Origination Fee: 5% (~$3,000)

- Monthly Payment: ~$700 post-graduation over 10 years

Risks: Currency fluctuations if returning to Nigeria, job uncertainty.

Benefits: Covers tuition + living expenses, builds U.S. credit.

Scenario 2: Undergraduate Student

- Loan: $45,000

- Interest-only in school, full repayment after graduation

- Monthly Payment: ~$500

- Risk: Interest accrual increases total repayment

Scenario 3: Returning to Nigeria After Graduation

- Monthly USD Payment: ~$700

- Naira Equivalent: At 1 USD = 1,000 NGN → 700,000 NGN/month

- Strategy: Save USD while abroad, plan remittance to cover payments

Currency Risk And Smart Planning

Currency fluctuations are the biggest hidden risk for Nigerian students borrowing in USD.

Strategies:

- Open a USD account while abroad

- Transfer part of your loan to a USD reserve

- Monitor Naira/USD rates to plan repayment

- Consider refinancing if rates drop

Example: Borrow $60,000. If Naira falls from 1,000 NGN/USD to 1,200 NGN/USD, your monthly payment rises from 700,000 NGN to 840,000 NGN — a 20% increase. Planning ahead mitigates this risk.

Application Process Step-by-Step

- Check Eligibility

- Prepare Documents: Passport, transcripts, admission letter, cost estimates

- Submit Application

- Conditional Offer

- Visa Support Letter

- School Certification & Fund Disbursement

- Set Up Repayment

MPOWER streamlines the process, but attention to detail is key.

RELATED:

SBA Loan for Small Business: Ultimate Guide for Entrepreneurs

Nigeria’s Best Business Loan Rates for 2025: A Complete Comparison of Banks, BOI & Fintech Platforms

Top 10 Fintech Apps for Nigerian Small Business Accounting and Analytics 2025

Tips to Maximize MPOWER for Nigerian Students

- Borrow only what you need

- Apply for scholarships alongside the loan

- Activate autopay for discounts

- Save USD while studying

- Maintain good credit

- Explore refinancing after graduation

Comparing MPOWER to Other Options

| Option | Pros | Cons |

|---|---|---|

| MPOWER Financing | No cosigner, high limit, fixed rate, support | USD repayment, long-term debt, origination fee |

| Nigerian Bank Loans | Borrow in Naira | Collateral required, limited loan size, high interest |

| Scholarships | Free money | Highly competitive, may not cover all costs |

| Part-Time Work | Reduces debt, experience | Visa restrictions, limited income |

Student Feedback & Lessons Learned

Likes:

- No cosigner requirement

- Fixed interest rates

- Interest-only in-school payments

- Career and visa support

Criticisms:

- Origination fee increases cost

- Occasional delays in disbursement

- High effective interest rates in some cases

Broader Implications

- MPOWER democratizes access to global education for Nigerian students

- Encourages financial literacy and responsible borrowing

- Could influence Nigerian banks to innovate student loans

- Raises questions about currency risk and systemic exposure

Conclusion

MPOWER Financing is not a silver bullet, but when used strategically, it can be a life-changing opportunity for Nigerian students. Borrow wisely, plan for currency risk, and leverage MPOWER’s support tools to make your dream of studying abroad a reality.

Frequently Ask Questions (FAQs)

What is MPOWER Financing for Nigerian students?

MPOWER Financing is an international student loan provider that helps Nigerian students study in the U.S. or Canada without a guarantor, collateral, or U.S. credit history.

Can Nigerians apply for MPOWER Financing in 2026?

Yes. Nigerian students can apply for MPOWER Financing in 2026 after receiving admission into an approved university in the U.S. or Canada.

Does MPOWER Financing require a guarantor in Nigeria?

No. MPOWER Financing does not require a Nigerian or U.S. guarantor, collateral, or credit history.

How much loan can Nigerian students get from MPOWER?

Eligible Nigerian students can borrow between $2,001 and $100,000, depending on their course, school, and total cost of education.

Does MPOWER Financing help with student visas?

Yes. MPOWER provides a visa support letter that Nigerian students can use as proof of funds when applying for U.S. or Canadian student visas.

Leave a Reply