Starting a micro startup in California is both exciting and challenging. With high operational costs, competitive markets, and complex tax requirements, effective budgeting and cash flow management for micro startups in California is essential to maintain liquidity, optimize operations, and ensure long-term success. This guide provides deep analytical insights, practical examples, step-by-step calculations.

Understanding the Financial Landscape of California Micro Startups

California’s startup ecosystem, from Silicon Valley to Los Angeles, offers immense opportunities but comes with high operating expenses. Over 60% of small businesses fail due to poor cash flow management (Small Business Administration, 2022). Understanding revenue streams, cost structures, and financial obligations is critical for successful budgeting and cash flow management for micro startups in California.

Key Considerations:

- Revenue Sources: Product sales, service fees, grants, and investment funding.

- Expense Breakdown: Fixed costs (rent, salaries, software), variable costs (materials, marketing), and one-time costs (legal, equipment).

- Separation of Finances: Maintain separate business accounts for clarity and accurate tax reporting (California Franchise Tax Board, 2023).

- Startup Stage: Early-stage startups often face more volatility in revenue; planning must account for this.

Step 1: Creating a Realistic Budget for Your Micro Startup in California

Budgeting and cash flow management for micro startups in California begins with creating a realistic, actionable budget.

1.1 Estimating Revenue

- Base forecasts on realistic assumptions, market research, and historical trends.

- Include seasonal fluctuations and potential delays in client payments.

- Example Calculation: A micro startup selling eco-friendly apparel in Los Angeles projects $15,000 monthly revenue, considering holiday sales spikes.

RELATED:

Best Business Intelligence Tools for Non-Profit Finance Teams in the USA (2025 Insight & Analysis)

1.2 Categorizing Expenses

| Expense Type | Monthly Allocation (USD) | Notes |

|---|---|---|

| Fixed Costs | 5,000 | Rent, salaries, software, insurance |

| Variable Costs | 4,000 | Marketing campaigns, raw materials, logistics |

| Contingency Fund | 1,500 | Unexpected repairs or emergency costs |

| Reinvestment/Profit | 4,500 | Growth initiatives and savings |

1.3 Allocating for Contingencies

- Set aside 10–15% of monthly revenue for unexpected costs.

- Micro startups in Los Angeles with contingency funds were 30% more likely to survive the first year (California Small Business Report, 2023).

1.4 Visualizing Budget Allocation

Step 2: Detailed Cash Flow Management

Efficient cash flow management for micro startups in California ensures that your business can pay bills, invest in growth, and avoid financial crises.

2.1 Tracking Inflows and Outflows

- Track weekly to maintain real-time visibility.

- Include client payments, supplier invoices, payroll, taxes, and loan repayments.

| Week | Cash Inflow | Cash Outflow | Net Cash Flow |

| 1 | 3,500 | 3,000 | 500 |

| 2 | 4,000 | 3,500 | 500 |

| 3 | 3,000 | 3,200 | -200 |

| 4 | 4,500 | 4,000 | 500 |

2.2 Forecasting Cash Flow

- Monthly projections help anticipate shortages or surpluses.

- Allows for proactive planning and strategic adjustments.

- Analytical Insight: Startups forecasting 6 months ahead reduce unexpected shortfalls by 40%.

2.3 Strategies to Improve Cash Flow

- Prompt invoicing and consistent follow-ups.

- Negotiate extended payment terms with suppliers.

- Offer early payment discounts to incentivize clients.

- Maintain a cash buffer equivalent to 20% of monthly expenses.

Case Study: A San Francisco marketing micro startup improved cash flow by 25% by implementing early payment incentives (SBA, 2022).

Step 3: Expense Optimization Without Hindering Growth

Smart cost management enhances financial stability without slowing growth.

Techniques for Micro Startups

- Audit recurring subscriptions and eliminate low ROI services.

- Evaluate marketing campaigns using Customer Acquisition Cost (CAC) and Return on Investment (ROI).

- Use co-working spaces or remote work to reduce rent.

- Outsource non-core tasks to freelancers or virtual assistants.

Analytical Example

If marketing campaigns cost $2,000/month with a CAC of $50 per client, and revenue per client is $200, ROI = (Revenue – Cost)/Cost = (200-50)/50 = 3X. If another campaign has ROI of 1X, consider cutting it.

3.1 Expense Trend Chart

Step 4: Tax Planning and Compliance in California

California micro startups face multiple taxes that should be integrated into cash flow management.

Key Taxes

- State Income Tax: Varies by business structure.

- Sales Tax: Applied to goods sold within California.

- Payroll Taxes: Includes unemployment, disability insurance, and federal contributions.

Budgeting for Taxes

- Allocate a portion of revenue monthly to cover taxes to avoid year-end surprises.

- Example: A micro startup earning $10,000/month may set aside $1,200 for income tax and $800 for payroll taxes.

- Consider hiring a CPA for accurate tax planning and filing.

References: California Department of Tax and Fee Administration, 2023; California Franchise Tax Board, 2023

Step 5: Leveraging Technology and Tools

Modern tools enhance budgeting and cash flow management for micro startups in California.

- Accounting Software: QuickBooks, Xero, FreshBooks.

- Cash Flow Tools: Float, Pulse.

- Budget Templates: Google Sheets, Excel.

- Government Resources: SBDC California, SCORE mentoring programs.

Practical Example

Automating invoices and tracking payments in QuickBooks can reduce overdue invoices by 30%, improving net cash flow.

5.1 Technology Adoption Table

| Tool | Purpose | Benefit |

| QuickBooks | Accounting & Invoices | Reduces human error & automates reporting |

| Float | Cash Flow Forecasting | Predicts shortages & surpluses |

| Google Sheets | Budget Templates | Customizable and low-cost |

| SBDC Mentoring | Financial Guidance | Expert advice & compliance tips |

Step 6: Reviewing and Scaling Financial Strategy

Regular review ensures adaptability:

- Monthly Reviews: Compare budgeted vs. actual figures.

- Quarterly Adjustments: Adjust for market trends and seasonal variations.

- Annual Evaluation: Set goals, reinvest profits, and plan growth initiatives.

Example: A Los Angeles tech micro startup reinvested profits into targeted marketing campaigns after analyzing ROI and cash flow trends, resulting in 20% revenue growth year-over-year.

Step 7: Expanded Case Studies with Analytics

7.1 Freelance Marketing Agency, San Francisco

- Early invoicing and payment incentives improved cash flow by 25%.

- Reduced outstanding accounts receivable from 40 days to 20 days.

- Applied SaaS tools for automated bookkeeping.

7.2 Eco-Friendly Apparel Startup, San Diego

- Reduced overhead using co-working spaces and freelancers.

- Increased profit margins by 15%.

- Integrated inventory management software to optimize stock levels.

7.3 Tech Service Provider, Silicon Valley

- Monthly cash flow forecasts prevented late payments.

- Automated bookkeeping via SaaS tools.

- Implemented detailed KPI dashboards for revenue, expenses, and client acquisition.

Step 8: Common Mistakes to Avoid

- Mixing personal and business finances.

- Underestimating operating costs.

- Ignoring seasonal revenue fluctuations.

- Failing to maintain contingency funds and tax allocations.

Implement accounting software and regular audits to avoid these pitfalls.

Step 9: Additional Analytical Tips for Growth

- Maintain banking relationships for flexible credit options.

- Track metrics: burn rate, runway, and profit margins.

- Negotiate favorable client and supplier terms.

- Explore strategic partnerships to share costs.

- Use scenario analysis to simulate financial outcomes under different revenue and expense conditions.

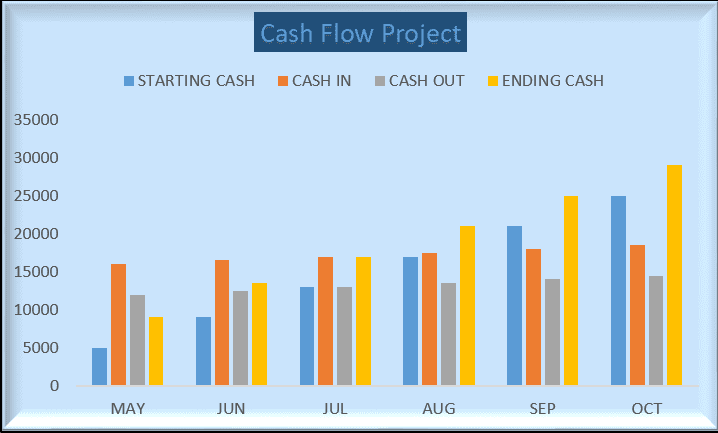

Step 10: Visualizing Success with Charts

10.1 Revenue vs Expense Chart (Monthly)

10.2 Cash Flow Projection (6-Month Forecast)

Conclusion

Effective budgeting and cash flow management for micro startups in California is crucial for financial resilience and sustainable growth. By understanding finances, creating realistic budgets, monitoring cash flow, reducing unnecessary expenses, planning for taxes, leveraging technology, and applying analytical insights, micro startups can thrive even in competitive markets.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Proceed